Microsoft and Yahoo are now Partner for 10 years

6:28 AM Posted by Jason

On Wednesday, Microsoft Corp and Yahoo Inc have announced the 10 year web search deal. They have tied to curb Google’s worldwide search dominance.

On Wednesday, Microsoft Corp and Yahoo Inc have announced the 10 year web search deal. They have tied to curb Google’s worldwide search dominance.This deal was expected for long and now the Bing will be sole search engine for both the Yahoo and MSN. But the market is not at all happy with the deal. Yahoo shares have been fall by 12% as the investors were disappointed with the revenue sharing method and also with the lack of upfront payment. Google’s market price also down by 0.8%. Only Microsoft shares gave a bright face by advancing 1.4%.

According the deal now Bing will be the search engine for Yahoo site also. Yahoo sales team will work for the premium ad search selling.

This deal will not be effective right now it needs at least 2.5 years for getting the regulatory approval that means we have to wait for 2012 for the outcome of the deal. So lets hope for the best as Google is going to get its biggest contender in the name of Bing. Although still Google reigns at the helm as it is already having 65% search domination where as the Yahoo MSN combination is having only 28% search share in the world. Still lets hope for the best that Google is going to face its biggest threat in its reign.

How Much is Car Insurance for a 16 Year Old?

6:41 AM Posted by Jason

Today we have got a question in our comment section and he was asking “how much is car insurance for a 16 year old”.

A 16 year old boy or girl feels the excitement when he / she try to drive a car by his/ her own. But in the background there is also a fear works as they are very inexperienced about the road. So insurance is a must for them. But when you go to contact the insurance companies to know that how much is car insurance for a 16 year old then you can be awestruck with the amount they charge.

We should not blame the insurance companies for this huge bill. It has been historically proved that the teenager or 16 to 18 year old people are more prone to excitement and also to accident. Most of the accident cases happen in the hand of the amateur drivers. So the insurance companies don’t leave the opportunity to loose and make huge cash of it. There are other factors also that control these premiums like vehicle type, age of the vehicle, use of the vehicle, type of the coverage you are applying for etc. Sex is also plays a great part while determining the premiums. A girl will cost less than the boy as boys are more prone to accident. In US state wise the premium differs for better idea you can check the free online insurance quotes available in the webs. The quotes can make you understand what factors are costing you more and which make less.

If you child is a brilliant student then he or she can get 15-20% discount also in premiums. But before signing in the form make sure that the insurance company is a reputed company and is not going to cheat you in case of emergency.

A 16 year old boy or girl feels the excitement when he / she try to drive a car by his/ her own. But in the background there is also a fear works as they are very inexperienced about the road. So insurance is a must for them. But when you go to contact the insurance companies to know that how much is car insurance for a 16 year old then you can be awestruck with the amount they charge.

We should not blame the insurance companies for this huge bill. It has been historically proved that the teenager or 16 to 18 year old people are more prone to excitement and also to accident. Most of the accident cases happen in the hand of the amateur drivers. So the insurance companies don’t leave the opportunity to loose and make huge cash of it. There are other factors also that control these premiums like vehicle type, age of the vehicle, use of the vehicle, type of the coverage you are applying for etc. Sex is also plays a great part while determining the premiums. A girl will cost less than the boy as boys are more prone to accident. In US state wise the premium differs for better idea you can check the free online insurance quotes available in the webs. The quotes can make you understand what factors are costing you more and which make less.

If you child is a brilliant student then he or she can get 15-20% discount also in premiums. But before signing in the form make sure that the insurance company is a reputed company and is not going to cheat you in case of emergency.

Bad Credit

11:54 PM Posted by Jason

Sensible usage of your credit cards not only enables you to enjoy a high credit score but you stand a better chance of getting credit. The credit cards have played a significant role in creating the credit crunch in USA. If you do not use your credit cards judiciously your debts may pile up ultimately disrupting your financial stability. As long as you are making regular payments you have a stable credit score.

Sensible usage of your credit cards not only enables you to enjoy a high credit score but you stand a better chance of getting credit. The credit cards have played a significant role in creating the credit crunch in USA. If you do not use your credit cards judiciously your debts may pile up ultimately disrupting your financial stability. As long as you are making regular payments you have a stable credit score.Having a low credit score does not mean you have ruined your chances of getting credit again. There are a number of ways to repair your credit. You can get your credit repaired on your own or with the help of a credit repairing company.

Selecting the right debt solution depends largely on your prevailing financial condition. While a particular debtor may need just a credit counseling session, another debtor may have to go through the entire process of debt consolidation or may be debt settlement.

You may choose to solve your own debt problems. If this is the case, you can opt for the self repayment plan.

Self repayment

You are confident that you can get out of debt on your own. What you need to do is make a list of the debt accounts you have (if you have availed more than one loan) and take a note of the outstanding balance. Budget your expenses and try to curb unnecessary expenditure.

You may be intending to avail a loan to repay your already existing debts but this only leads to more burden. This is mainly due to the fact that sooner or later you will have to return the loan amount. It is best to opt for a credit repair program instead.

Get professional help

Take professional advice if you cannot decide which credit repair program will suit your needs best. When you hire the services of the credit repairing company, they work on your behalf and negotiate with the creditors. A repayment schedule is worked out and this allows you to make payments as per your convenience. By enrolling for a credit repair program you not only enjoy a lower rate of interest but also a lower monthly payment. In addition to this, you stop receiving calls from the creditors and the collection agencies. Your debts become more organized and in due course you become debt free and your credit score improves.

Some more articles you can check:

*Life Insurance and the Single Parent

*The Basics of Mortgage - Part 2

Citigroup Surprised Wall Street & Makes a Profit of $3 billion

9:48 AM Posted by Jason

Citigroup has registered $3 billion profit the quarter II. Earlier the market predicted a loss for the bank.

Citigroup has registered $3 billion profit the quarter II. Earlier the market predicted a loss for the bank.Now Citibank has become fifth big bank to make a profit in the quarter. The bank made profit of $3 billion or 49 cents per share after paying the dividends. In 2008 quarter II the bank had faced loss of $2.86 billion. Some times ago the market analysts had forecast that the bank was heading for a loss of 37 cents per share.

But the bank has proved all of them wrong. The group made $6.7 billion profit after selling its majority stakes at Smith Barney. The bank has also been able to recover some good value of its assets that were lost during recession. This New York based bank was one of the worst hit financial institutions by the credit crunch and recession. It has got stimulus fund from the government also and the fund is now showing its effect.

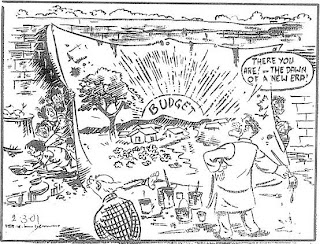

Its Fun Time

5:38 AM Posted by Jason

I have got some funny cartoons you can check. These are the creation of a great cartoonist from India, his name is RK Laxman. Hope you will find them interesting. If you liek these then don't forget to leave a comment.

Tips to Save Money while Refinancing your Mortgage

8:28 AM Posted by Jason

To save money in mortgage, we opt for refinancing the existing mortgage. This way we can get lower interest rates and also more user friendly terms. But if we want we save more cash if we follow some tips. If we follow the tips, we can be sure that it is going to help us by cutting the fees and costs further.

To save money in mortgage, we opt for refinancing the existing mortgage. This way we can get lower interest rates and also more user friendly terms. But if we want we save more cash if we follow some tips. If we follow the tips, we can be sure that it is going to help us by cutting the fees and costs further.Close Inactive Cards

First close all the inactive or useless credit card accounts, this can help you having a good credit score and also help you to get lower interest rates. Right now inform the credit card companies to close those junk cards. In the next credit report you will find that you have closed the credit card account by yourself not due to bad credit. After getting the credit report also check that there is no wrong information about your credit.

Try to avoid the PMI

When you are going to borrow 80% of current home value, then you have to pay a huge amount as private mortgage insurance. The lender can add it to your refinance bill smartly as hidden cost. So, check whether you have to pay the PMI or not.

Opt for short term mortgage

Choose short term mortgage as it can save a lot of money in interest rates. Short term mortgage can also provide lower interest than longer term mortgage. This can save big amount of money.

Know about the fees

Many mortgage loan contains many fees which generally not declared before taking the mortgage, these are kept hidden. But by the law, the lenders are bound to disclose all the fees within 3 days of the mortgage application. There can be fees like – courier fees, document preparation fees, administrative fees, etc.

He is Barack Obama

5:45 AM Posted by Jason

Have you seen Barack Obama like this? You can love him, respect him, idolize him, but I can challenge you can never be able to visualize him like that. He is not a man he is a super man who can rescue us from any danger that can hurt us. Check the "Super Obama"

Don't forget to let me know do you like it or not... :)

Don't forget to let me know do you like it or not... :)