Banks with no Overdraft Fees: Consider some tips

6:11 AM Posted by Jason

When you have to pay extreme amount of bank fees, it often becomes disagreeable to you. And when you are among the persons who handle their money very cautiously, it is more undesirable to pay a few hundred dollars every month as overdraft fees.

This is a carefully contrived strategy by banks to compel customers to pay fees. Banks are supposed to reorganize order of purchases, processing large purchases and small

purchases accordingly.

Another policy that they often use is to sign up clients routinely in plans like “overdraft protection”. People initially take it as an aid and overdraft their account. Little after this, banks shed off this as an excuse and start charging the customers.

Even if people became aware of this situation, the problem lies in the fact that all big banks except a few national banks are employing this device.

Consider a few things before going for banks that do not charge overdraft fees.

1) Go for a bank which ensures an online sign up system.

2) Make sure the bank is FDIC covered.

3) Go for it if only it allows you online banking, balance transfer etc.

There are few banks which do not employ overdraft-fees and are set for business. Select carefully and it may lead you to choose the right bank for you.

Banks that do not charge overdraft-type fees are still rare, but they are out there and open for business. Most banks prefer to continue to make huge money off of their customers in the form of overdraft fees. It's worth making the effort to find a bank that refuses to charge overdraft fees of any sort.

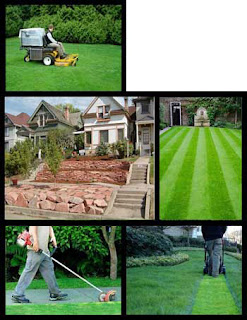

For Landlords: Some Reasons to go for Property Management Company

9:07 AM Posted by Jason

Some landlords call upon some property management company to settle the entire matter for them. However, here are few reasons which one needs to be aware of, before going for it.

No.1) Local Property Management Companies have more proficiency in matter of property management. For example, relying on them one will have a proper rate concerning rent, supplies and vendors. This will none the less help you to gain your right aim.

No2) Once your property is added to the company’s own rental list, be sure of getting huge response from the interested tenants. It won’t be far that you will get the benefit out of it.

No3) Getting an honest tenant is one of the toughest things possible. But when the company will ensure you of a truthful and best suitable tenant, you are likely to relax.

No4) There are numbers of confusing and complex laws concerning this property rent which leads one often to possible mistakes while renting a property. If you trust a management company, they will look after this arena of legal concern.

No5) Often rent collection becomes a nightmare especially in case of stubborn tenants. But now automated banking has solved this problem making it sure that you get your money in time. All these headaches you can deliver to the company.

No6) The company officials will keep an eye on your properties letting you know of any damage or problem which may incur to your property. Regular inspection will ensure that your property is safe and secured.

These are some benefits which one can get by letting his property looked after by an efficient property management company. This might have you shedding some money, but it will save you more if you consider well. However one can manage his property on his own. But these tips will help them to reconsider if they face any problem while going with it.

Investment advice 401k

9:46 AM Posted by Jason

The 401K plan in USA allows the workers to save for their retirement and can save the income taxes on the saved money until the withdrawal. Generally the employee chooses to move a portion of wage directly into the 401K or pension account. Financial term this is called “contribution”.

The 401K plan in USA allows the workers to save for their retirement and can save the income taxes on the saved money until the withdrawal. Generally the employee chooses to move a portion of wage directly into the 401K or pension account. Financial term this is called “contribution”.Most of these 401K plans are being sponsored by the employer as a benefit to the employee. The employee can also contribute some more if he likes. In the most popular participant-directed plans the employee can identify the investment plan where he wants to invest. The employee can choose to invest in mutual funds, stocks, bonds, money market or those with a mix portfolio. Even some employer offers the employee to purchase the company stock with the money. So to secure a healthy retired life the proper financial advice is essential to invest the money.

The right investment advice 401K can always help to find serenity of future. Basically there are some available investment options are to put the money in mutual funds with

* Mid cap stock fund

* Large cap stock fund

* Small cap stock fund

* International stock fund

* Bond fund

* Money market fund

Based on these funds and their respective risk factors and high return, you have two different investment options in Growth and conservative portfolio. Generally the people with a long term investment goal invest in growth portfolio which have a risk factor although the return is high. But in conservative portfolio the risk is less but the return is not as high, so taking the financial advice for 401K always better. Lets checkout a video on investing the 401K money.

Adverse Credit Remortgage - Way to Reduce Monthly Installments

6:03 AM Posted by Jason

There are many people around us who pays huge payment every month for their mortgage. To pay these installments many of us have to take extra pressure and sometime installment burden seems unbearable. Especially in these situation when the economy is not completely out of recession and our pocket is not so healthy. These installments can hamper our financial plan and financial health. In this situation we try to come out of this situation but can’t find any way out to free ourselves.

There are many people around us who pays huge payment every month for their mortgage. To pay these installments many of us have to take extra pressure and sometime installment burden seems unbearable. Especially in these situation when the economy is not completely out of recession and our pocket is not so healthy. These installments can hamper our financial plan and financial health. In this situation we try to come out of this situation but can’t find any way out to free ourselves.But there is an easy way out is to have an easy debt consolidation which can minimize the debt and then go for a remortgage loan. This is true that in this way your credit score can go down and you can have to face some refusal from the mortgage lenders for your adverse credit. But don’t be afraid, there are also numerous lenders who offer adverse credit remortgage for the people with poor credit. The adverse credit remortgage is a specially design program which can help you a lot. This way you can find the option to change the lender with a lower rate.

Some lending institutions of adverse credit remortgage loans also offer cash outs which can help you to get some extra money for your personal expense and can be helpful for fulfilling immediate needs. Some time you can find lower rates of adverse credit remortgage loan than your regular loan.

Adverse credit remortgage loan is a kind of secured loan that can be obtained against your property as security. Generally adverse credit remortgage loan have longer repayment schedule and lower monthly payments to reduce the financial burden. You can find many lenders in the net who are offering adverse credit remortgage loan and get some quotes from them. Then compare them to get the best terms.

If you can repay the new adverse credit remortgage loan on time then this will increase your credit score significantly and can help you to find easy loans in future.

At first analyze your financial situation and choose which will be better in your situation. Always read and understand the terms and condition of the lender before having any adverse credit remortgage loan and then only decide on the lender to smoothen your financial situation.

Some Related Posts:

How many Times can you Refinance a Mortgage?

Tips to Save Money while Refinancing your Mortgage

SOME SUGGESTIONS FOR LANDLORDS

12:04 AM Posted by Jason

While renting out a residential property, the home-owner must not necessarily be in want of money. There are other factors as well. But becoming a landlord (at the same time being the owner) is an additional duty to keep an eye on the tenants. Be cautious while selecting a tenant.

Once you place an advertisement in the local newspaper, sometimes you are required to inform the local authority. Besides, you will have to buy some home-insurance policies in order to avoid expanses due to any disasters.

If you are in position to rent your property, then follow these tips.

Plan an advertisement on the local newspaper:

Seek some space in the classified column in any local newspaper. Only you have to pay some bucks to get your message reached out to thousands.

Inform the local authority:

Some countries have a stricter law, while some only seek a plan documentation process. Don’t take risk. Just pay some fees to the local authorities informing them of your plan. It causes you nothing while this small thing can save you in future concerning any official requirements.

Selecting a Tenant:

Before selecting your tenants, you should check out the local laws. For example you cannot rent your property to any commercial organization or company. Gather information about the moral character and financial condition of your tenant. He should have a fair record in the local authorities. These facts may cause you enough safety concerning your property.

Buy a home-insurance policy :

Insurance policy completes the entire device of protection of your policy. It will not bother you financially if there is some damage in the property. Some policies can give you extra advantage in matter of non-payment of rent and such things. One should select one form the many available policies of reputed insurance companies.

Funny Parody of Credit Card Advertisement

10:07 AM Posted by Jason

CREDIT REPAIR AND SIMPLE LIFE ARE SYNONIMOUS

11:13 PM Posted by Jason

THE HAPPINESS BEHIND THIS TASK

Are in sinking in debts? Do your credit reports need a repair? Are you seriously embarking on having a striking credit report?

Are you worried thinking how much changes you need to bring in your life while attempting a credit repair?

Well trust me; you don’t have to be an announcer of renunciation of your earthly pleasures. Just give some space to enter the happiness in. And for this, prepare yourself just by giving up some bad habits, which will essentially bring you your desired happiness of seeing your repaired new credit report.

BALANCE

Friends, this is the right time to make a perfect equilibrium between your earning and spending. Start balancing your budgets, wealth and start living your life of simplicity, Precision and cleanness. This will reflect in your credit report. This power of balancing will give you enough confidence, while you are attempting on credit repair.

CONTROL YOUR FINANCE

It is high time for your mental as well as economical steadiness. Once you learn balancing the budget, you will be able to drive away the unforeseen expanses. and that moment will witness your savings policy.

TAKE IT EASY

Start budgeting in a sportive mode. Try to consider it as an adventure. First of all, make a list of your expanses. Include everything from big monthly expenditure to trivial essentials. Now it’s for you to decide your areas, from where you can trim down costs. You will find it interesting that you are able to cut down cost quite easily, without giving yourself much pain.

SIMPLIFY YOUR BUDGET

I have seen many of my clients, suffering from bad credits, who have given us such wonderful feed backs. Many people have successfully avoided pleasures in order to save much money. From entertaining themselves to cooking, they have discovered a whole new way of living which promised them transparency in their lifestyle.

This change of outlook will provide you with newer vision which will not only help you to cover credit repair, but also to face newer possibilities with a brave new approach.

So many people have done it, and so can you. All the best.

How many Times can you Refinance a Mortgage?

8:14 AM Posted by Jason

I Need a Personal Loan Quick But I Have Bad Credit

5:32 AM Posted by Jason

“I Need a Personal Loan Quick But I Have Bad Credit”? Today I got this question in my mail from Sarah. Thanks Sarah for posting such a relevant query in this financial turmoil. In this time of recession many people are asking the same question again n again as they fall in the trap of credit score.

“I Need a Personal Loan Quick But I Have Bad Credit”? Today I got this question in my mail from Sarah. Thanks Sarah for posting such a relevant query in this financial turmoil. In this time of recession many people are asking the same question again n again as they fall in the trap of credit score.It is very tough to maintain a good credit score. In some conditions, when the financial needs are greater than the income then you are bound to fall in the trap of credit score and your well maintained credit score can reach the level of bad credit and then you have to face rejection in most of the financial transactions. If you ask for a personal loan then the lending institution will reject the plea as your credit score is not good. In this situation the person always try to ensure that his loan application doesn’t get rejected again. But is that possible?

The answer is “Yes!” Today many of the financial institutions are offering loan to people with bad credit. The terms and conditions are varies lender to lender. In most of the case the lender can ask for collateral from the borrower. The collateral can be anything like home, automobiles, ornaments etc. The payment schedule of these secured loans is flexible and easy to cope with and can repay the amount easily without facing much hassle.

But when the person with bad credit wants a loan but don’t have any collateral as security, then he has to face problems for getting a loan. If he gets a loan, then he has to pay huge interest rate which makes the loan payment tough. He can only get a small amount as loan and the loan has to be paid within very short time. This makes the loan really a stiff decision to make. So secured loan is better for the people with bad credit. The quick payday loan can burn your pocket and can drown you in worst credit future, so always try to find a reputable company for the bad credit personal loan and also check the interest rate before signing the documents.

These are the ways in which you can solve the puzzle of "I need Personal Loan Quick But I Have Bad Credit". Don't forget to ping me if you have any more questions that are baffling you.

Obama: Recession's not over yet

10:05 AM Posted by Jason

For complete report checkout the complete article at CNN

Microsoft and Yahoo are now Partner for 10 years

6:28 AM Posted by Jason

On Wednesday, Microsoft Corp and Yahoo Inc have announced the 10 year web search deal. They have tied to curb Google’s worldwide search dominance.

On Wednesday, Microsoft Corp and Yahoo Inc have announced the 10 year web search deal. They have tied to curb Google’s worldwide search dominance.This deal was expected for long and now the Bing will be sole search engine for both the Yahoo and MSN. But the market is not at all happy with the deal. Yahoo shares have been fall by 12% as the investors were disappointed with the revenue sharing method and also with the lack of upfront payment. Google’s market price also down by 0.8%. Only Microsoft shares gave a bright face by advancing 1.4%.

According the deal now Bing will be the search engine for Yahoo site also. Yahoo sales team will work for the premium ad search selling.

This deal will not be effective right now it needs at least 2.5 years for getting the regulatory approval that means we have to wait for 2012 for the outcome of the deal. So lets hope for the best as Google is going to get its biggest contender in the name of Bing. Although still Google reigns at the helm as it is already having 65% search domination where as the Yahoo MSN combination is having only 28% search share in the world. Still lets hope for the best that Google is going to face its biggest threat in its reign.

How Much is Car Insurance for a 16 Year Old?

6:41 AM Posted by Jason

A 16 year old boy or girl feels the excitement when he / she try to drive a car by his/ her own. But in the background there is also a fear works as they are very inexperienced about the road. So insurance is a must for them. But when you go to contact the insurance companies to know that how much is car insurance for a 16 year old then you can be awestruck with the amount they charge.

We should not blame the insurance companies for this huge bill. It has been historically proved that the teenager or 16 to 18 year old people are more prone to excitement and also to accident. Most of the accident cases happen in the hand of the amateur drivers. So the insurance companies don’t leave the opportunity to loose and make huge cash of it. There are other factors also that control these premiums like vehicle type, age of the vehicle, use of the vehicle, type of the coverage you are applying for etc. Sex is also plays a great part while determining the premiums. A girl will cost less than the boy as boys are more prone to accident. In US state wise the premium differs for better idea you can check the free online insurance quotes available in the webs. The quotes can make you understand what factors are costing you more and which make less.

If you child is a brilliant student then he or she can get 15-20% discount also in premiums. But before signing in the form make sure that the insurance company is a reputed company and is not going to cheat you in case of emergency.

Bad Credit

11:54 PM Posted by Jason

Sensible usage of your credit cards not only enables you to enjoy a high credit score but you stand a better chance of getting credit. The credit cards have played a significant role in creating the credit crunch in USA. If you do not use your credit cards judiciously your debts may pile up ultimately disrupting your financial stability. As long as you are making regular payments you have a stable credit score.

Sensible usage of your credit cards not only enables you to enjoy a high credit score but you stand a better chance of getting credit. The credit cards have played a significant role in creating the credit crunch in USA. If you do not use your credit cards judiciously your debts may pile up ultimately disrupting your financial stability. As long as you are making regular payments you have a stable credit score.Having a low credit score does not mean you have ruined your chances of getting credit again. There are a number of ways to repair your credit. You can get your credit repaired on your own or with the help of a credit repairing company.

Selecting the right debt solution depends largely on your prevailing financial condition. While a particular debtor may need just a credit counseling session, another debtor may have to go through the entire process of debt consolidation or may be debt settlement.

You may choose to solve your own debt problems. If this is the case, you can opt for the self repayment plan.

Self repayment

You are confident that you can get out of debt on your own. What you need to do is make a list of the debt accounts you have (if you have availed more than one loan) and take a note of the outstanding balance. Budget your expenses and try to curb unnecessary expenditure.

You may be intending to avail a loan to repay your already existing debts but this only leads to more burden. This is mainly due to the fact that sooner or later you will have to return the loan amount. It is best to opt for a credit repair program instead.

Get professional help

Take professional advice if you cannot decide which credit repair program will suit your needs best. When you hire the services of the credit repairing company, they work on your behalf and negotiate with the creditors. A repayment schedule is worked out and this allows you to make payments as per your convenience. By enrolling for a credit repair program you not only enjoy a lower rate of interest but also a lower monthly payment. In addition to this, you stop receiving calls from the creditors and the collection agencies. Your debts become more organized and in due course you become debt free and your credit score improves.

Some more articles you can check:

*Life Insurance and the Single Parent

*The Basics of Mortgage - Part 2

Citigroup Surprised Wall Street & Makes a Profit of $3 billion

9:48 AM Posted by Jason

Citigroup has registered $3 billion profit the quarter II. Earlier the market predicted a loss for the bank.

Citigroup has registered $3 billion profit the quarter II. Earlier the market predicted a loss for the bank.Now Citibank has become fifth big bank to make a profit in the quarter. The bank made profit of $3 billion or 49 cents per share after paying the dividends. In 2008 quarter II the bank had faced loss of $2.86 billion. Some times ago the market analysts had forecast that the bank was heading for a loss of 37 cents per share.

But the bank has proved all of them wrong. The group made $6.7 billion profit after selling its majority stakes at Smith Barney. The bank has also been able to recover some good value of its assets that were lost during recession. This New York based bank was one of the worst hit financial institutions by the credit crunch and recession. It has got stimulus fund from the government also and the fund is now showing its effect.

Its Fun Time

5:38 AM Posted by Jason

Tips to Save Money while Refinancing your Mortgage

8:28 AM Posted by Jason

To save money in mortgage, we opt for refinancing the existing mortgage. This way we can get lower interest rates and also more user friendly terms. But if we want we save more cash if we follow some tips. If we follow the tips, we can be sure that it is going to help us by cutting the fees and costs further.

To save money in mortgage, we opt for refinancing the existing mortgage. This way we can get lower interest rates and also more user friendly terms. But if we want we save more cash if we follow some tips. If we follow the tips, we can be sure that it is going to help us by cutting the fees and costs further.Close Inactive Cards

First close all the inactive or useless credit card accounts, this can help you having a good credit score and also help you to get lower interest rates. Right now inform the credit card companies to close those junk cards. In the next credit report you will find that you have closed the credit card account by yourself not due to bad credit. After getting the credit report also check that there is no wrong information about your credit.

Try to avoid the PMI

When you are going to borrow 80% of current home value, then you have to pay a huge amount as private mortgage insurance. The lender can add it to your refinance bill smartly as hidden cost. So, check whether you have to pay the PMI or not.

Opt for short term mortgage

Choose short term mortgage as it can save a lot of money in interest rates. Short term mortgage can also provide lower interest than longer term mortgage. This can save big amount of money.

Know about the fees

Many mortgage loan contains many fees which generally not declared before taking the mortgage, these are kept hidden. But by the law, the lenders are bound to disclose all the fees within 3 days of the mortgage application. There can be fees like – courier fees, document preparation fees, administrative fees, etc.

He is Barack Obama

5:45 AM Posted by Jason

Don't forget to let me know do you like it or not... :)

Are You Feeling Too Aged for a Life Insurance?

6:03 AM Posted by Jason

HERE ARE 5 THINGS TO REMEMBER

1. Keep an eye on the shop :

You will find it amazing how prices can differ from one company to the other. The premiums are going to vary greatly making it all the more important for you to take the time to shop around. Thanks to the internet it has never been easier than it is today to look at several different rates in a matter of minutes. You can find a wide array of information on the internet to help you compare rates, view different options, and purchase the best policy for you.

2. Be fit and find fine policies :

Stay healthy and you are surely going to get good policies. Any chance of disease which threatens your fitness, can affect the rate. Activities like smoking, excessive drinking, engaged in risk actions will be counting for. Any routine changes like taking up daily exercise can help to advance your health at the same time providing you with better policies.

3. analyze reports regularly

It is imperative for you to make paces with the changing coverage. Normally you get a look at the coverage either at the end of a year or the commencement of the next. It is very important that your coverage still goes with any alteration you have through including divorce, being a parent, or retiring.

4. Evaluate your choice

There are enormous options to choose from. Each category has special character and repayment for you to get benefit of. There are a number of things which will offer instant profit while there are some which will recommend remuneration for your entire life. Take your time to pick up the best option available for you and your life.

5. Buy more, pay less

Life insurance naturally costs less per thousand dollars at advanced coverage amounts. If you choose to twice your coverage your premium is not leaving to twice as well. If you require adding to your life insurance, it is very important for you to discover everything out there. Surprisingly, you may be able to get with this at a far improved price than you initially thought.

Travels Insurance: A Few Advices

5:46 AM Posted by Jason

Travel insurance has conventionally been alleged as a dissipation of time and money, but that is absolutely not the case. The profits of travel catastrophe insurance policies are massive if you call for them. But if you are fortunate enough not to boast to contact them then you forever have that security of mind that it is there in the background.

Like other insurance, travel insurance can be perplexing if you are desirous to get the right policy for you but is striving to obtain the benefits of individual policy. I am giving you certain facts concerning the travel policies

FACT 1 – What kind requires me most?

At the top of everything there are two kinds of policies single trip and annual. As their name suggests the annual trip will be beneficial for those traveling throughout the season while single plan is essentially for those who are planning for one big trip. They are available with almost same benefits leaving the option to you to pick up.

FACT 2 – How much do I need to pay?

The cost depends largely on four factors supplier, the sum, the extent of your trip and your age. It is obvious that a child’s policy will be cheaper than an adult’s. So if you travel, the annual policy will save a lot of money.

FACT 3 Will I inform the company about my state?

Yes of course. The policy will be unnecessary if you do not inform them about your health and position. Don’t keep secrets about illnesses for that will not ultimately lead you to save money.

FACT4- Are all places covered under the policy?

Trekking on a mountain will not come under the normal insurance while tripping on beaches will have. If you inform them they will happily add extra sum on the plan.

Chose any of the policies only after learning all the terms and conditions which will eventually help you to make all the coverage while keeping the peace of mind.

Some Factors Determining Average Cost of Car Insurance for the Teenagers

12:17 AM Posted by Jason

1) One of the major influencing factors that you face while rating the cost of car insurance for a teenager, is the age of the driver. Gradually as you grow up the premium rates decrease. This is because maturity brings less chance of accident.

1) One of the major influencing factors that you face while rating the cost of car insurance for a teenager, is the age of the driver. Gradually as you grow up the premium rates decrease. This is because maturity brings less chance of accident.2) Driver insurance policy forms a certain part of the average cost of car insurance for teenagers. But that option depending upon the vehicle concerned can be dropped down. But for that one has to know his or her vehicle condition well.

3) Another determining factor is the usage of the car, which none the less going to influence the average cost of your car insurance. You should mention the place where you are going to use the car- in hilly regions, or plain. Similarly you will get premiums accordingly.

4) Different states in U.S.A. employ various rates of policies. Like rates in L.A. will be different from rates in Chicago. One interested in these costs of car insurance especially for teens may look up at the comparison charts at the State Department of Insurance.

Thus try to keep in mind these factors while attempting for your car insurance. Different policy quotes should be surveyed maintaining these factors. You will be benefited while trying to have knowledge on the average cost of car insurance for teenagers.

What is the Average Cost of Car Insurance for a Teenager?

5:47 AM Posted by Jason

"What is the Cost of car insurance for the teenagers"? This is the foremost query which crops up in your mind, while purchasing a new car for your teenage children or especially when you have a teenager who likes to drive the car. Car insurance is a must for the new drivers and you should know in advance how much it is going to hurt you.

"What is the Cost of car insurance for the teenagers"? This is the foremost query which crops up in your mind, while purchasing a new car for your teenage children or especially when you have a teenager who likes to drive the car. Car insurance is a must for the new drivers and you should know in advance how much it is going to hurt you.Companies providing auto-insurance always approach you using schemes that also include youngsters’. But according to survey large number of accident take place in the hands of young drivers (under 16 years of age). So it is obvious that the auto insurance companies will jump on these opportunities loading high amount of premiums in case of these adolescents. But as they grow up, sum of premium also shrink. So the average cost of car insurance for a teenager is always going to be higher than the others. This teenage car insurance premium will burn your pocket more.

Car insurance companies would love to get customers who don’t claim upon the policy and are subsequently rewarded. This plan called as ‘no claims discount’, offers the customers considerable discount of up to 75% of the yearly premium. Although this has to be collected between 5 to 7 years of your plan. Teenagers do not necessarily involve themselves with only one company but this claim is open to several others. For example you can at a time receive 1 year no claim discount of one company, while simultaneously earning 3 year plan of another one. If you buy insurance for your daughter or son then the premium can rise to 50-100%. Generally if you pay 2000$ for your insurance and eager to have insurance for your daughter then the cost can rise by 50% and you can have to pay near about 3000$ and if you like to have your son's insurance, then the cost can rise to near about 4000$.

Number of factors controlling average cost of car insurance for a teenager -

1. The kind of car used for insurance (like engine power, age of the car etc.)

2. Driver’s age

3. How old the car is

4. Security devices (if any)

5. Your purpose behind buying the car(personal or business)

6. Mileage measured during a certain period

7. Position of your garage

8. Rank of cover involved like 3rd party or else.

If you like to evaluate the cost of the car insurance for a teenager by yourself, then try to have a look at different online websites and get an online quote. It will take very little time to make you endowed with the data of the average cost of car insurance for a teenager and also what you can have to pay. In this method you can gather valuable information, needed to judge the cost of car insurance for a teenager, and moreover you don't have to waste a single penny for that. This knowledge also help you to choose the right insurance company.

Some More Related Articles:

Some Factors Determining Average Cost of Car Insurance for the Teenagers

How Much is Car Insurance for a 16 Year Old?

SAVE MONEY EVERY NOW AND THEN: THROW AWAY THE HABIT NAMED CREDIT CARD

6:08 AM Posted by Jason

Troubles with credit card handling are the outcome of bad habits mounted up over the years. Good quality credit card managing doesn't happen overnight without bringing an amendment in manners of holders. At the end of the day the credit card charges end up mistreating them. Here are some methods to use to pay off debt and perk up your financial strength:

Troubles with credit card handling are the outcome of bad habits mounted up over the years. Good quality credit card managing doesn't happen overnight without bringing an amendment in manners of holders. At the end of the day the credit card charges end up mistreating them. Here are some methods to use to pay off debt and perk up your financial strength:Don't buy much small products to make it heaped up into your credit card balance. The handiness of credit cards has turned them so dangerous. We use them for the innumerable purchases, largely those minor ones, such the trip to the saloon, the DVD store, the eatery. It is much alarming to obtain your monthly account and discover all those little expenses added up to an $900 balance-that the credit card group is now readily applying charges. In our frantic schedule it is natural not to recall how many expenditures we formulate every month.

Two simple practices are:

1) Use your debit card instead of credit card. It takes the cost of the thing (you have bought) out of your bank account, so there is no question of credit balance laid to yourself open at all, and no additional charges. You are to buy only what you can afford right then. While using this card use this frequently, but, be sure to take away all the dealings from your checkbook right then, while the expense is recurring in your mind. You won’t desire to end up terminating your bank account and perhaps bouncing checks.

2) Best thing is to use CASH. If you are not adept in carrying it with you, revitalize your memory bearing it now. Don’t need to hold a large amount while $50 or $200 are enough for all those trivial expenditures, those $40-$60 items that put up to the wide credit card balance at the end of the month. ATMs are there to help you where you need cash withdrawals nearly every nook and corner. Moreover, you are bound only to spend the money you have in your bank. You are therefore applying reliable financial management.

This technique grounds for allowing you to keep the card for big deals. The most beautiful thing is that, you will no longer have a mean shock when you unlock your card statement. Pay off debt and keep in mind: Credit, used intelligently, can be an helpful tool for running your finances with greater easiness.

Your Family Budget just 3 steps away

6:23 AM Posted by Jason

Have you ever tried to make a cost-cutting by making your family-budget? Not yet? Are you not sweeping with the worldwide wave of recession? It must be fear which is working in you. For, in case failure in maintaining that, it might generate in you the sense of helplessness. So why do not you try my innovating 3 fundamental elements of budgeting.

Have you ever tried to make a cost-cutting by making your family-budget? Not yet? Are you not sweeping with the worldwide wave of recession? It must be fear which is working in you. For, in case failure in maintaining that, it might generate in you the sense of helplessness. So why do not you try my innovating 3 fundamental elements of budgeting.Essentially all you have got to do , is, to put things in place so that your expenditure is lesser to your income.

STEP ONE- It is important that you track accounts of money needed to be spent in different places like grocery shop, telephone, transportation, entertainment etc. Keep an eye on how much money is getting out of your bank account. Make this paper on common places where usually you are available.

STEP TWO- Do at the same time keep datas clearly stating the sources of your income and most importantly the amount. Every single money receive you should put down.

STEP THREE- Make four columns –first indicating places where you have spent money, second showing how much money you have spent on each and every thing, third showing the source of getting that ,and fourth or the last one showing how much money you obtained. Count both of these columns and see which one is larger. If the sum of your income is better than your operating expense, then you are in fine form. If not, subsequently you have to observe where you can slash your operating cost or lift your revenue.

From today starting following this and you will see how you flourish in these hard days.

Some Recession Proof Jobs

4:58 AM Posted by Jason

The dark recession is grappling all the US and everybody is awe struck with the epidemic of pink slip. Almost every company is sacking their employees from top to bottom to cut their cost. The companies are forcing the employees to work for 2-3 persons single handedly to cut the extra cost. So in this situation all the people are looking for the recession proof professions.

I like to help you out by providing some light on this matter.

Here is some recession proof jobs that will help you to keep your night sleep intact.

1. Debt Management Specialist :

Debt management specialists help you to get out of your debt. They work on clients financial problems and try to make the client get out of debt. For this they charge money. In most companies the Debt managers work on incentive basis but some companies offer fixed salaries too. In this market when every body is under debt this job is going to bloom more than the past.

2. Career Coach:

Another lucrative recession free job is the job of Career coach. In this time of slow economy, every body is trying to get a job. In this situation career coach is their sole helper. By giving them proper guidance you can gift your life a tension free future.

3. Construction Worker:

Carpenters, tradesmen, plumbers, electricians and other construction workers are always needed when there is any need of repair. No recession can stop you from repairing your pipes or house. So, this job will remain an all time hit.

4. Debt Collector:

Next recession proof job is the job of a debt collector. This job will not be able to give you satisfaction as you have to deal with loan and other debt defaulter. You have to contact them and make them to pay their due. But this job will not let you jobless as long as people ask for debt beyond their payment limit. So no recession can affect it.

5. Auctioneer:

The job of auctioneer is very little known but going to be hit as recession proof job. An auctioneer can help you selling different items like houses, valuable arts etc. No recession can steal away the job of an auctioneer as the banks and government always have to auction things to get money. So it’s better to opt for these jobs. Don’t think much otherwise the recession can offer you a pink slip.

Know the Credit Score Before You Get the Mortgage

9:28 AM Posted by Jason

Checking your mortgage credit score online, you'll instantly compare where you are standing and measure up to the national average of 680 points. You'll be able to see just what kind of mortgage you can obtain.

This information will make you know what your banks will endorse you for. You can tell how much you can collect in favor of home loan, what charge you should get agreed upon, and what your monthly mortgage fee will be.

These are valuable information to buy a home for this is the way to know about your payment structure according to your home loan, which depends upon the quality of your house. Apart from this if your score is lower than you assumed, you have to make a down payment.

Knowing this beforehand you can boost your ranking before the lender got to see it. Things will ultimately fall according to your strategy.

5 MISTAKES TO STAY AWAY CONCERNING CREDIT CARD DEBT - Part 3

6:38 AM Posted by Jason

No 4 Mistake (Not to do): You acquire a Home Equity Loan or Personal Loan to disburse Your Debts

No 4 Mistake (Not to do): You acquire a Home Equity Loan or Personal Loan to disburse Your DebtsApparently this sounds a great idea. Your credit debts are compensated, and you have serenity within you. But the problem is that liability has not disappeared; it has turned in the shape of a loan now. Yes your credit card groups are no longer harassing you for imbursement, but you will still be receiving a monthly statement from the bank and you will almost certainly be obligated a larger bare minimum to them than you would on your cards. The troubles really commence to crop up when you have the loan costs and you don't stop with your credit cards. Keep away from this difficulty by paying off your cards without getting support from the bank.

No 5 Mistake (Not to do): Time and again you pay the minimum balance

When you decide to compensate the least balance on your credit cards, the credit card companies pick the profit. At standard interest rates of 15% - 20%, companies are gathering in millions on your unpaid costs and due balance. It is comprehensible that you may not be clever enough to pay off the whole sum in one recompense, but always strive to pay as much as you can to bind the interest you will pay in the upcoming days.

For previous two parts check Part 1 & Part 2

5 MISTAKES TO STAY AWAY CONCERNING CREDIT CARD DEBT - part 2

6:27 AM Posted by Jason

No 2 Mistake (Not to do): You merge Your Debt

Paying one big amount of bill has got to be superior rather than paying many lesser bills, but for somebody of course, if you can avoid this do so at all costs! Companies can abandon your credit card and bank accounts. Moreover, your credit report will be an indication of "third party assistance" when you are with a liability consolidation service. If you require paying off your credit card bills with one monthly amount, think about by means of the "waterfall" way of recompense.

With this technique, you decide a bump figure like $500 per month that you wish for paying. You then obtain your card with the maximum balance or maximum interest (this is supported on your priorities), and use the greater part of your $500 per month on the road to that bill. You then place a part of that toward your subsequent utmost priority card, a lesser section to the third priority, and so on.

No 3 Mistake (Not to do): You Pay a lofty Interest Rate on Your Credit Cards Without Inquiring It

Every now and then you will be in a situation where you can't bargain a lower interest rate with your credit card group. If you are in good position, have good quality credit, and put together customary expenditure above the minimum, you are in a place to potentially lesser your charges. Surveys explain an average of 57% of populace who gather the criterion above were winning in lowering interest charges by just calling his credit card party. Certainly there should be an impulse to give it an attempt! Just call up your credit card company, give details to them that you have been a fine customer, and request them if they could decrease your interest rates.

For the rest of the article check Part 1 & Part 3

5 MISTAKES TO STAY AWAY CONCERNING CREDIT CARD DEBT - Part 1

6:20 AM Posted by Jason

If you are burdened with credit card debts, you should shake yourself to pay it off. It is important to decide the actual point of time while keeping in mind how to disburse. Learn 5 ways to avoid mistakes while paying it off at the same time maintaining your good credit score.

If you are burdened with credit card debts, you should shake yourself to pay it off. It is important to decide the actual point of time while keeping in mind how to disburse. Learn 5 ways to avoid mistakes while paying it off at the same time maintaining your good credit score.No 1 Mistake (Not to do): You withdraw Your Credit Cards driven by sheer discontent

You make contact with credit card companies to cancel the cards. This could be a grand way out to stop payments, but could ground for immense damage to your credit score. Because it sends negative vibes to credit bureau. So withdrawing your cards isn't the solution. But you call them the company to ask them to settle up you up with a payment plan. If you can uphold a steadiness which is not more than 25% of your credit limit, credit score will get better.

For rest of the article check part 2 & part 3

The Basics of Mortgage - Part 2

10:05 AM Posted by Jason

Types of Mortgage

Mortgage also depends on mortgage term and interest rates. The mortgage term is usually 15 or 30 years. There are rates too of two types Fixed rate or adjustable rate mortgage. In fixed rate mortgage the mortgage interest rate will be same through out the loan term. In case of adjustable rate mortgage, its completely opposite to the previous. In ARM (adjustable rate mortgage) the mortgage rate fluctuates according to the market rate. The most popular mortgage is 30 year mortgage of fixed rate. This longer time frame will lower the monthly payment and the fixed rate will stabilize your future payment. With the lower interest rate it is very popular among the borrowers. But its problem is that if the interest rate declines then still you have to pay the older high interest rates. But if you have good credit history and adequate income then you can opt for refinancing your mortgage if the mortgage interest rate goes down. There is another term is also available its 40 years mortgage.

Mortgage Rates and Minimum Incomes Needed to Qualify

| Mortgage Rates and Minimum Incomes Needed to Qualify | ||

| Interest Rate | Monthly Payment | Minimum Annual Income |

| 4% | $454 | $21,770 |

| 5% | $510 | $24,479 |

| 6% | $570 | $27,340 |

| 7% | $632 | $30,338 |

| 8% | $697 | $33,460 |

| 9% | $764 | $36,691 |

| 10% | $834 | $40,017 |

| 11% | $905 | $43,426 |

| 12% | $977 | $46,905 |

|

From: National Association of Home Builders, The Economics Division. | ||

Some other options:

When you can’t afford a conventional mortgage, there are many options available in the market. The seller can sometime propose owner financing. FHA (Federal Housing Administration) can also offer you loan at merely 3% down payment but then you have to buy mortgage insurance. For the veteran U.S. army personnel, the VA (Veterans Administration) can offer no money down payment mortgage. You can local mortgage lenders, FHA, Fannie Mae or VA for more information on mortgage options.

The Basics of Mortgage - Part 1

10:03 AM Posted by Jason

Generally home buyers always been confused over many issues such as which mortgage to choose, adjustable rate or floating and for how many years? Even how much mortgage can I afford? I am trying to solve some of these problems through this series of posts.

Purchasing a house is the biggest financial investment that we make in our whole lifetime. Before doing any large project, there are many intriguing issues that can haunt us and make our decision complex. Similarly buying a home is also full of complex tasks and we cannot escape them. The cleverest approach is to break the process into some smaller tasks. Such three steps are

1. Check all your records and data.

2. Taking decision about your affordability.

3. Looking for mortgage options available.

Before searching for a home, you should decide on how much loan you can afford. Some mortgage lender can prequalify the borrower up to an amount determined by them. If you be prequalified then you can search a home with a realistic budget in your mind. But being prequalified you have to submit the loan application and this process can take sometime.

You should also check your credit report. First contact your local lender and find out which credit bureau they are using. After that get in touch with the credit bureau and apply for your credit report. You can get free individual credit report in most of the states. Then check whether all the details are ok or not. Don’t worry much if you find the past credit problems in the report. Present a justified reason for the inability to pay in past and also show how your ability to pay have been improved and you can pay on time.

2009 Experiencing the Used Gold Rush

10:33 AM Posted by Jason

All the economically downtrodden Americans today are trying to sell their jewelry and gold to have some extra cash. As the gold price is shooting upwards, the used gold sell is attracting more Americans than anything else. People from every income level are going to sell their old unused gold to earn some quick cash.

All the economically downtrodden Americans today are trying to sell their jewelry and gold to have some extra cash. As the gold price is shooting upwards, the used gold sell is attracting more Americans than anything else. People from every income level are going to sell their old unused gold to earn some quick cash.According to report gold prices have almost gone up by 50% since 2006 where as the stock price has been down by 37%. So it’s a high time for the Americans to encash their long saved high return gold power. Even diamond is also being tried for quick cash.

For this growing interest of selling valuable jewelry and major gems, auction houses are also finding themselves in the seventh heaven. They are also trying to be selective while choosing the auction items and antiques.

In these days the gold prices is increasing whereas the other gem prices are not so lucky. The diamond price has been down from last year.

For the complete report check the full story at here

Some Important Things that Gas Stations won’t Let you Know

9:47 AM Posted by Jason

Every one of us refuels our car at gas stations but are you sure that you know all about the stations and their fuels? Don’t go by their big oil company names. There are many factors that you should know to save your money and also to break the wrong ideas.

Every one of us refuels our car at gas stations but are you sure that you know all about the stations and their fuels? Don’t go by their big oil company names. There are many factors that you should know to save your money and also to break the wrong ideas.Do you think every branded gas stations offer same rate for your gasoline? Then avoid your permanent gas station and go near by gas stations. Generally oil companies give gas to gas stations at different rates depending on some factors like competition of the station and the location (station at town must have costlier gasoline). So always look for the cheapest station.

Another misconception is costlier gasoline are better because their additives can make your engine clean and environment fresh. But this is not true. There is very little difference between different branded gases.

Your debit card also can cost you dearer if you have very little balance left. Some banks also charge you for using the card. Checkout the complete article here